My bs meter is shrieking because all we gotta do is pay our people and protect everyone within circle of influence

On Tue, Jun 9, 2015, 7:02 PM Cliff Küle <cliff.kule@cliffkule.com> wrote:

View this email in your browser

Cliff Küle's Notes Recent posts below in case you missed them ... simply click and read - enjoy!

LINK HERE to our website www.cliffkule.com

Excerpts:

HOW COMPLETE WOULD ACOLLAPSE HAVE TO BE BEFORECENTRAL BANKS ARE DISCREDITED?"Central bankers have 'explained' how they will keep everything under control? Are those the same central bankers who presided over the Great Depression, the series of inflationary recessions of the 1970s, and the series of giant bubbles and financial and economic crashes of the past few decades? The same central bankers whose policies have actively contributed to the extant credit and money supply exploding into the blue yonder over the past four or five decades? The same ones who were fantasizing about the 'Great Moderation' just before it blew up into their faces and who couldn't recognize a bubble if it bit them in their collective behind? .. We have no idea what needs to happen to finally discredit the policy of incessant money printing. Probably nothing short of a total systemic collapse will do. Obviously, people have yet to learn a thing from what has happened thus far. If three major bubbles and two major busts over the past 20 odd years couldn't do it, what can? We confess we are at a loss for an answer – in fact,

not even a complete collapse of the currency system may suffice, since it would in all likelihood be blamed on what's left of the market economy."

- Acting Man

LINK HERE to the essay

Read on »

The Most Fantastic BubbleIn Recorded HistoryDavid Stockman* highlights how central bankers have created the biggest financial bubble in human history .. "There has been so much overinvestment in the last few years because of financial repression" .. 4 minutes

Watch the latest video at video.foxbusiness.com

Read on »

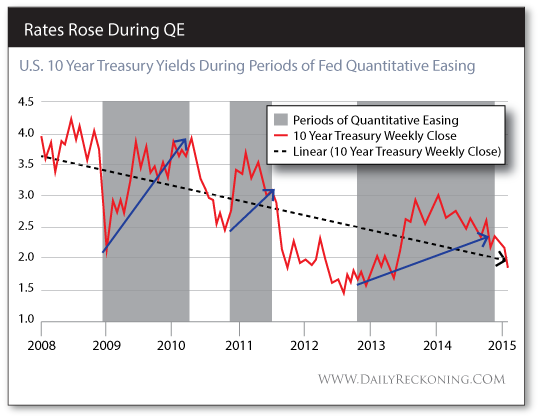

Jim Rickards* onFederal Reserve PolicyJim Rickards* points out the above chart how interest rates went in the opposite way expected from Federal Reserve quantitative easing programs .. "Why do rates rise when the Fed is easing and fall when the Fed is not easing? The answer has to do with investor expectations. The Fed may believe the economy is getting stronger, but investors and everyday Americans know better — the fundamentals are weak and getting weaker. When the Fed prints money (that's what QE is), investors expect inflation, and therefore rates rise. When the Fed stops printing money, investors expect deflation, and therefore rates fall." .. Rickards concludes that it is difficult to see how the Federal Reserve can raise rates in 2015 without sinking markets & the economy - therefore an interest rate increase should not be expected.

LINK HERE to the commentary

Read on »

The Creature from Jekyll Island :A Second Lookat the Federal ReserveDiscussion with G. Edward Griffin, widely acknowledged expert on the Federal Reserve & author of the book The Creature from Jekyll Island: a Second Look at the Federal Reserve .. He has opposed the Federal Reserve since the 1960s, saying it constitutes a banking cartel & an instrument of war & totalitarianism. In this interview, Griffin, exposes the truth behind the institution that has dominated for over a hundred years .. 31 minutes

Read on »

On China: If your BS DetectorIsn't Shrieking, It's BrokenCharles Hugh Smith* points out one of the defining characteristics of an American used to be the sense of being able to detect BS .. this essay highlights that what is happening in China should be giving a high reading on the BS meter .. Smith sees China as being in one of the greatest credit bubbles of all time .. "China's credit machine is now dependent on a stock market bubble for its very survival. That speaks volumes about the true health of China's economy. Everybody who thinks China's economy is healthy because its stock market is soaring has been suckered .. If your BS detector isn't shrieking, it's broken."

link here to the commentary

Read on »

TAKE A BREAK?

If you like Aretha Franklin & little kids with personality, click on image to 3 minute video

Read on »

Denninger on Stretched ValuationsBoom Bu$t .. discussion with Karl Denninger of The Market Ticker on what asset markets he thinks are looking a little stretched & gives us his take on if the U.S. will see another recession anytime soon .. 1/2 hour total program

Read on »

click to enlarge

Read on »

THE WORLD, AS WE'VE KNOWN IT, IS ENDING

(THE WARREN BUFFET ECONOMY)

DEBTS (THAT CREATED GREAT WEALTH FOR A FEW) HAVE LEFT MEDIAN FAMILIES 'UNDER WATER', BECAUSE THOSE DEBTS NEED TO BE PAID BY SOMEONEANOTHER VERSION OF WHAT WE CALL 'THE CHART THAT SAYS IT ALL'5* BE SURE TO LINK & STUDY THIS ONE"The worldwide central bank ... impact was a one-time acceleration of global economic activity that temporarily inflated current income and further goosed the value of financial assets. This central bank fueled boom will ultimately be paid for in the form of a prolonged deflationary contraction. Then, trillions of uneconomic assets will be written off, industrial sector profits will collapse and the great inflation of financial assets over the last 27 years will meet its day of reckoning. On the morning after, of course, it will be asked why the central banks were permitted to engineer this fantastic financial and economic bubble. The short answer is that it was done so that monetary central planners could smooth and optimize the business cycle and save world capitalism from its purported tendency toward instability, under performance and depressionary collapse."

- David Stockman*

LINK HERE to the essay

Read on »

U.S. Social Security BenefitsDemystified With EconomistLaurence KotlikoffBoston University economics professor & author of Get What's Yours explains why millions of Social Security recipients aren't getting what they're entitled to .. 36 minutes

Read on »

Guess How Many NationsIn The World Do Not HaveA Central Bank?Michael Snyder answers North Korea & a few small island countries in the Federated States of Micronesia .. wonders how the concept of cental banking has been taken up by the entire world .. asks why in the U.S. a private banking cartel (the Federal Reserve) has been given the authority to create & manage the money supply - The U.S. Constitution specifically delegates that authority to Congress .. "It is not as if we actually need the Federal Reserve. In fact, the greatest period of economic growth in U.S. history happened during the decades before the Federal Reserve was created. Unfortunately, a little over 100 years ago our leaders decided that it would be best to turn over our financial future to a newly created private banking cartel that was designed by very powerful Wall Street interests. Since that time, the value of our currency has diminished by more than 96% and our national debt has gotten more than 5000 times larger."

LINK HERE to the essay

Read on »

Will Germany Guarantee theCredit Standing of Europe?"In a comic tragedy though, German CDU political party member Detlef Seif conceded that Athens "could not reasonably repay its debt." Herr Seif seemed to be adamant that 'The EU IS NOT A TRANSFER UNION.' .. Please, make note of this quote for it will come to the forefront over the next two years: 'IF THE EU IS NOT A TRANSFER UNION ITS ENTIRE REASON FOR BEING IS CALLED INTO QUESTION. GERMANY MAY NOT BELIEVE IT IS THE TRANSFER AGENT BUT THE EU PERIPHERY AND GLOBAL INVESTORS BELIEVE IT IS SO. HOW ELSE CAN THE ULTRA LOW SOVEREIGN BOND YIELD BE EXPLAINED FOR THE ECB IS ONLY AS SOLID AS THE GUARANTEE OF THE GERMAN FINANCIAL SYSTEM. IF THE GERMANS FAIL TO GUARANTEE THE CREDIT STANDING OF THE ENTIRE EU PROJECT THEN THE GLOBAL FINANCIAL SYSTEM WILL BE IN TURMOIL' HERR SEIF .. The EU is nothing but a transfer union until the GOOD BAVARIAN BURGHERS SAY OTHERWISE."

- Yra Harris

link here to the commentary

Read on »

Investors need to keep an eye on interest rates around the world. He looks back to 4 years ago when gold hit its record and looks at rates during that time compared to today. He also brings up inflation & the U.S. dollar .. 4 minutesFrank Holmes*:

Keep an Eye on Interest Rates

Read on »

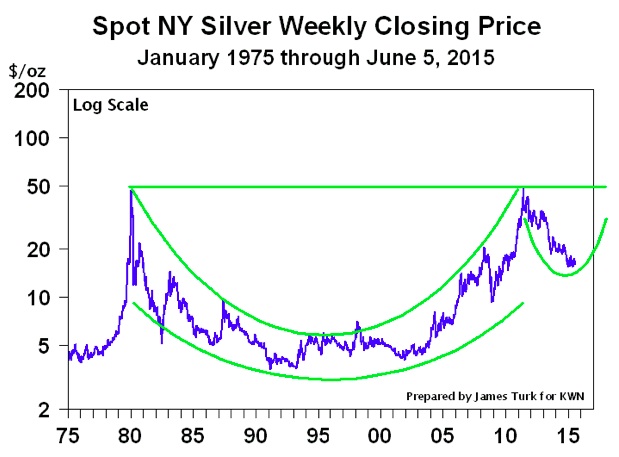

click to enlarge

Read on »

James Turk:Most Underpriced Assetin the World"This long-term chart is showing a very clear picture of the great prospects for silver, which I think is the most underpriced asset in the world .. Because it is a long-term chart spanning over a few decades, it can seem like nothing has changed. But with each passing week, this 'cup and handle' pattern continues to develop. This pattern being developed makes this chart without a doubt one of the most ominous charts I have ever seen in my 50-year career, and I have seen a lot. Now of course a long-term chart like this one that spans four decades is not saying that silver has turned higher and the bull move has resumed. But it will do two things. It will help you identify an underpriced asset that is being accumulated by strong hands, and second, it will keep you on the right side of the market because this chart is shouting 'higher prices are coming.'"

link here to the article

Read on »

The QuietFinancial Revolution BeginsMohamed El-Erian* shares his vision of where he sees the financial sector evolving to .. it's a vision similar to Nassim Taleb's "utilities" model .. increased regulations are tightening supervision of financial institutions - "This will contribute to further generalized de-risking within the regulated sectors, as part of a broader financial-sector movement toward a 'utilities model' that emphasizes larger capital cushions, less leverage, greater disclosure, stricter operational guidelines, and a lot more oversight. The pricing environment compounds the impact of tighter regulation. Like utilities, established financial institutions are facing external constraints on their pricing power, though not of the traditional form. Rather than being subjected to explicit price regulations and guidelines, these institutions operate in a 'financial repression' regime in which key benchmark interest rates have been held at levels below what would otherwise prevail. This erodes net interest margins, puts pressure on certain fee structures, and makes certain providers more cautious about entering into long-term financial relationships. As a result of these two factors, established institutions – particularly the large banks – will be inclined to do fewer things for fewer people, despite being flush with liquidity provided by central banks (the 'liquidity paradox')."

LINK HERE to the essay

Read on »

A Brief Historyof Currency WarsJim Rickards* writes in International Man on a brief history of the currency wars in the past & on the one currently in progress .. "Currency wars are one of the most important dynamics in the global financial system today. A currency war is a battle, but it's primarily economic. It's about economic policy. The basic idea is that countries want to cheapen their currency. Now, they say they want to cheapen their currency to promote exports. Maybe it makes a Boeing more competitive internationally with Airbus. But the real reason, the one that's less talked about, is that countries actually want to import inflation .. Currency wars are like a see saw — they go back and forth and back and forth."

LINK HERE to the essay

Read on »

U.S. AdministrationTargeting Americans'Retirement AccountsWealth Confiscation = Financial Repression"The U.S. Administration is buying into the argument that the people are saving too much, and is using this to entertain the idea of placing a cap on how much an individual is allowed to contribute to their retirement plan. Additionally, it is considering adding a 10% or so tax on your 401k or IRA account. He believe that you should not be allowed to leave your children anything .. it is also considering a provision that would require, in many circumstances, you to empty your inherited retirement account in 5 years or less .. This is the unfolding of the Debt Crisis – not a currency crisis."

- Martin Armstrong

link here to the commentary

Read on »

A Six-Point Plan to RestoreEconomic Growth & ProsperityIn his latest letter, John Mauldin* shares a 6-point approach he developed with Stephen Moore to foster economic recovery:

1. Streamline the federal bureaucracy.

2. Simplify and flatten the income tax.

3. Replace the payroll tax with a business transfer tax of 15%, which will give lower-income workers a big raise.

4. Provide certainty by keeping tax rates low through a tax-limitation constitutional amendment that would require future tax increases to be passed by 60% of the Congress, in combination with a balanced-budget amendment.

5. Roll back the regulatory state.

6. Drill for America's domestic energy and use the royalties on federal lands to retire the debt and/or fund needed infrastructure repair instead of raising taxes.

"Growth is the solution to nearly every social, economic, and financial problem in America, and we aren't getting enough of it. This is a plan that puts U.S. competitiveness first and brings middle-class jobs back to America."

LINK HERE to the letterClick "150606_TFTF" to download Mauldin's letter (may need to provide your email address), or hit "View Fullscreen" at the bottom next to the Scribd logo to enlarge viewing .. John Mauldin, Best-Selling author and recognized financial expert, is editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

Read on »

Parched Liquidity?Financial Times segment on bond liquidity issues .. Discussion on the impact of the European Central Bank's quantitative easing program on bond liquidity & market uncertainty over when the Federal Reserve will raise interest rates .. 5 minutes

Read on »

click to enlarge

Read on »

Copyright © 2015 www.cliffkule.com All rights reserved.

You subscribed to our free alert service.

unsubscribe from this list update subscription preferences