Excerpts:

When the Bond Bubble Bursts It Will Be A Disaster That Makes The 2008 Crisis Look like a Picnic "The financial crisis crash was a warm up .. It was a stock and investment bank crisis. But it was not THE Crisis .. THE Crisis concerns the biggest bubble in financial history: the EPIC BOND BUBBLE … which as it stands is north of $100 trillion… although if you include the derivatives that trade based on bonds it's more like $500 TRILLION .. Bonds are debt .. Because we never actually pay our debt off (or rarely do), what we do is ROLL OVER debt when it comes due, so that investors continue to receive interest payments but never actually get the money back… because the U.S. Government doesn't have it .. This is why the Fed cut interest rates to zero and will likely do everything in its power to keep them low: even a small rise in interest rates makes all of this debt MORE expensive to pay off .. This is also why the Fed had the regulators drop accounting standards for derivatives… because if banks and financial firms had to accurately value their hundreds of trillions of derivatives trades based on bonds, investors would be terrified at the amount of leverage and the margin calls would begin"

"The bond bubble is why the Fed started its QE programs. Because by buying bonds, the Fed put a floor under Treasuries… which made investors less likely to dump bonds

despite bonds offering such low rates of return .. The only problem is that by doing all of this, the Fed has only made the bond market even BIGGER .. The REAL Crisis will be when the bond bubble bursts .. It will make the financial crisis look like a picnic." [Küle Comment: Some 'outside the box thinking' that does not fit into the mainstream, but does fit into reality: Everyone seemed to ask where the 'inflation' is that so many analysts thought would happen with TRILLIONS of $$ in money printing. We gave you plenty of commentary to say that the 'inflation' did not have to be in the government measurement of inflation. There has been TRILLIONS of $$ of 'inflation' in the price of government bonds & Mortgage Backed Securities that were bought with the Fed's (& other central banks') money printed from thin air. Without it, the prices of those bonds would be much much lower. The price of bonds bought with QE money have been tremendously inflated. Those who run the financial system are fortunate that most people think the statistical numbers the authorities produce are giving all the important information. ASSET PRICE INFLATION is not something that central banks want you to be concerned about. Bond prices are where they are due to a man-made artificial 'prop' instead of being based on the solid foundation of free market forces. IF the artificial 'prop' breaks, the foundation is FAR BELOW.]

- Graham Summers

link here to the reference

DISCLAIMER: The report is a sales/marketing tool for Phoenix Capital. We neither endorse or criticize their paid services. We are saying they make good points & make them well. We trust our readers to 'separate the wheat from the chaff' when we post things that serve as someones' marketing material.

Read on »

The Bernanke Ten Spot The New York Sun remarks how former Federal Reserve Chair Ben Bernanke is claiming now to be a big fan of Alexander Hamilton [Note: BS!] - says he was "without doubt the best and most foresighted economic policymaker in U.S. history." .. Bernanke is opposing the demotion of Hamilton from his featured spot on the ten-dollar bill .. the irony is that while chairing the Federal Reserve, "Bernanke traduced every principle Hamilton held dear, particularly the idea of sound money defined by Congress. It was Hamilton who wrote the first law Congress passed under the authority the Constitution grants it to coin money and regulate the value there of, and of foreign coin, and to fix the standard of weights and measures. That piece of legislation, the Coinage Act of 1792, is the final fruit of what Hamilton envisaged in respect of money and the purest record of how he thought about the dollar."

Bernanke has no more regard for the principles of Hamilton than "he does for the man in the moon. In respect of the dollar, he opposes the very definition that Hamilton hewed.

The fact is that the ten dollar Federal Reserve note is worth today but a percent or two of what it was worth when the Fed was created. Maybe the face to put on it is neither Alexander Hamilton nor Harriet Tubman but Ben Bernanke himself."

LINK HERE to the essay

Read on »

Ellen Brown*: Secret Trade Deal Serves Corporations & Banks Greg Hunter interviews Ellen Brown* on the recent Trans-Pacific Partnership Agreement & other agreements as well - all conducted through secrecy .. "It looks to me the banking system is in control. That's where all the big money comes from, and that's where the two big parties got their money. It's been this way ever since Rockefeller and Morgan back then in 1900—the Democrats and the Republicans .. The goal here is 'they' want to own everything and rent it back to us. So, law is no longer a way to protect the people. Law is now to protect the corporations and serve the corporations." .. 16 minutes

Read on »

Comex Silver Is The Most Corrupted Market In History? Article highlights the insanity of the silver market, how never in the history of the markets has any futures market been disconnected from the amount of underlying physical commodity that is available to deliver .. a daily contributor to Lemetroplecafe.com's nightly Midas report comments:

"Total North American lumber production for 2015 (est.) is 60 billion board feet. At an average of $400 mbf that translates into $24 billion dollars. Keep in mind this excludes the rest of the world's lumber production, which could easily be double that amount. On the other hand total world silver mine production for 2014 was estimated by GFMS to be 877 million ounces. At $16 oz. that is a total of $14 billion.

Silver OI (open interest) is 45.45 times greater than lumber OI. with physical silver production being only a fraction of lumber production in dollars. Lumber futures O.I would have to be 100 times greater or more to compare to the outlandish oversized silver futures.

Or, put another way lumber futures would have to reflect hedging 68 billion board feet, more than the entire year's production for North America to be scaled to silver Any arguments for a higher silver O.I due to hedging for recycled and above ground silver supply are dwarfed by the stark reality of the above figures. To say the silver market is normal is like having referred to hurricane Katrina as a passing thunderstorm."

The article goes on to suggest some traders think that a default is coming to the silver market on the Comex exchange, which will cause the contracts to be settled in cash.

LINK HERE to the article

Read on »

The Federal Reserve Is Above the Law FinanceandLiberty interviews James Corbett on the Federal Reserve .. The Federal Reserve can now do anything it likes without consequences (implications from a recent court ruling)[Note: Cliff has explained it this way many times before: Whoever holds the government contract to issue & distribute the country's money controls the government that writes the laws that control the people. It is a virtuous circle if you are among the 'insiders' who hold the government contract to issue the money. It is a vicious circle if you are an 'outsider'. ALSO, It's a great 'gig' if you can get it.] .. Greek debt crisis .. Is Greece aligning with Russia? .. U.S. working China toward global governance? .. Texas's state bullion depository .. 35 minutes

Read on »

click to enlarge

Read on »

Consequences of Technology on the Economy Boom Bu$t .. discussion on issues of complaints by a tech giant against Google in Europe .. also a discussion of how mobile technology is affecting postal & courier services .. 1/2 hour total program

Read on »

The Coming Dislocation In Markets "Investors .. feel so strongly that Fed policies have worked and will work, weak data can only mean that strong data is coming soon. This is why we are finally approaching a pregnant moment .. because expectations are so high, yet the data doesn't support the outcome that those expectations require. When you have a mindset that is drastically different from the facts, at some point you can get a rather drastic change in psychology and dislocation in the markets. Obviously, this mindset has ramifications for stocks, currencies, metals, and to some degree bonds ..It is all about perceptions. They think the economy will be strong so the dollar should go up, though today it is more about the euro sinking on the Greece deal. The disconnect between expectations and reality is what sets up the potential for a large mindset shift at some point."

- Bill Fleckenstein

link here to the article

Read on »

Yield Purchasing Power THINK DIFFERENT About Purchasing Power  | | outsized chart for clarity |

Keith Weiner is the President of the Gold Standard Institute USA .. he understands sound money & purchasing power .. he has come up with the notion of yield purchasing power - a measure of the loss of purchasing power of fiat money . "CPI understates monetary debasement, because companies are constantly becoming more efficient. Dividing wealth by CPI compounds the error, because asset prices are rising. We need a different way of looking at monetary debasement. I propose Yield Purchasing Power (YPP). YPP is the yield on assets divided by the Consumer Price Index (or other index). The idea is to look at the productivity of assets to see what you can really afford. Let me explain YPP with a simple example. If hamburgers sell for $5 and interest is 10%, then $50 of capital lets you eat one burger per year. Suppose the price of the burger doesn't change, but the interest rate falls to 0.1%. You now need $5,000 in capital to earn that burger. Unfortunately, if you still only have $50, then you only get one burger every 100 years. CPI doesn't show this collapse in purchasing power, but YPP does."

LINK HERE to the analysis

Read on »

Bitcoin Gold & Freedom McAlvany Weekly Commentary .. Money = Time, Knowledge = Wealth, Learning = Growth .. A Million dollars in 1913 is now only $20,000 today! .. Velocity is the Freedom to Choose to spend or save .. the 21st century case for gold - a new information theory of money .. 39 minutes

Read on »

How Banks Could Confiscate Your Money

LINK HERE to the essay

Read on »

Globe & Mail Columnist on Investment Strategy? At the Canadian Investor Conference, Cambridge House interviews Globe & Mail columnist Fabrice Taylor on his investment strategy: harvest your gains & hold cash he says we are at the market top .. thinks higher interest rates will affect the stock & bond markets, value investing, investor mindset, selling discipline, having a minimum of 10% cash & staying liquid in small cap investing .. 8 minutes

Read on »

Dr. Gary Shilling*: The Era of Slow Growth Is Not Over Shilling thinkgs the U.S. 30-Year Treasury Bond could hit 2% .. Despite the Federal Reserve's forecasts of 4% U.S. growth since 2012, the reality has been in the 2% range .. Gary believes that 2% growth is likely .. short few minutes

DISCLAIMER: The short clip is a sales/marketing tool for Financial Sense. You need to subscribe to Financial Sense to listen to the whole interview.

Read on »

Dr. Marc Faber*: Central Banks Postpone Problems They Do Not Solve Problems "It's not just the Federal Reserve that has fueled the bubble, it's the other central banks .. the European Central Bank (ECB) that has fueled the bubble mostly with sovereign debt and bailed out Greece repeatedly .. As they bailed out Greece repeatedly, the problem became bigger and bigger and bigger. This is the problem of central banking today - they do not solve problems, they postpone problems .. There are huge distortions in the markets, where basically financial assets have been going up very substantially, and real wages for the typical household, or real household income, has been either flat or down. So it's created huge market distortions, and I think eventually this will be resolved by a massive deflation in asset prices."

- Dr. Marc Faber*

Watch the latest video at video.foxbusiness.com

Read on »

The Math of Underfunded Pensions Basic math to understand the nature of the underfunded pensions in Illinois. The sad story is that it is not only Illinois - it is virtually all states, provinces & municipalities across North America & even Western Europe .. Khan Academy video, made a couple years ago but still applicable .. courtesy of Danielle Park: "Greece is not alone in underfunding its pension plans. Thanks to destructive financial advice and planning over the past 20 years, most pensions, endowments and individuals are seriously under-capitalized today. The liabilities magnified by aging baby boomers were entirely foreseeable. Unfortunately most people did not like the math of how much present consumption had to be denied in order to save enough for the future. Now the future is here. Even after years of Fed enabled recovery in financial markets, spectacular deficits are the norm and pension commitments are now claiming funding needed for other vital social services like education." .. 7 minutes

Read on »

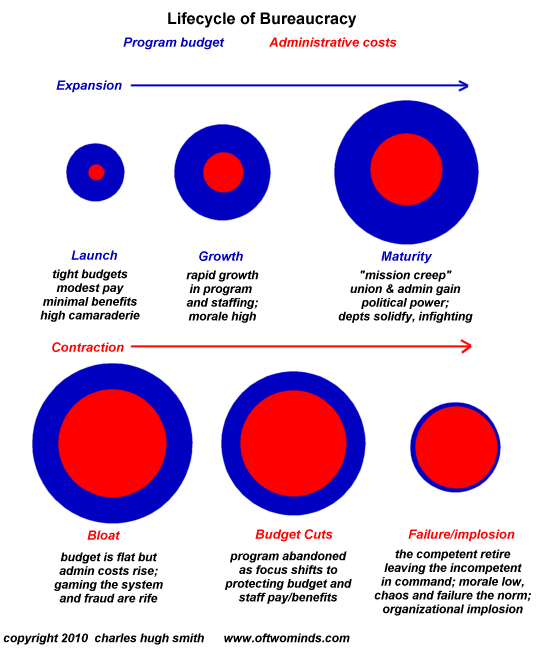

The Nine Dynamics of Decay Charles Hugh Smith* continues his series on collapsing systems .. Here are the nine dynamics of decay that lead to collapse:

1. complacency & intellectual laziness

2. profound political disunity

3. rise of unproductive complexity

4. those bearing the sacrifices opt out/quit

5. decay of effective leadership

6. rise of bread and circuses social welfare & entertainment to distract/placate restive citizenry

7. decline of wealth-producing capacity--status quo living off financial trickery

8. sclerosis--status quo controlled by vested interests

9. resource depletion/environmental damage

"Rome didn't fall so much as erode away, its many strengths squandered on in-fighting, mismanagement of resources, complacency and personal aggrandizement/ corruption. That's the template for collapse, and you see it in every status quo globally."

LINK HERE to the essay

Read on »

International Capital Flows: China is Importing Highly-Valued Entrepreneurial Capital

LINK HERE to the essay

Read on »

Regulatory Explosion Financial Survival Network interviews Frank V. Vernuccio, Jr. who says that the Regulatory Explosion has gone into hyper-drive.

If the U.S. Regulatory System was a country it would be the 10th largest economy.

Regulatory democracy has changed the relationship between the people & the government. Regulations have the effect of law but are not passed by legislative bodies & there's no accountability. Obamacare is typical of the regulatory state where we don't find out what's in it until after it's been passed .. 15 minutes

LINK HERE to the podcast

Read on »

Inflation Or Deflation? Peter Schiff* & Mike Maloney discussion .. 4 minutes

Read on »

click to enlarge Aidan wins the prize for most fun loving 4 year old

Read on »

|