Excerpts:

The U.S. Treasury Market Leaks?! Tough Questions for the Federal Reserve Boom Bu$t .. is the Federal Reserve attempting to disrupt U.S. Congressional oversight? .. a reporter in March asked Federal Reserve Chair Janet Yellen a tough question about an investigation on the Federal Reserve .. the reporter asked the question through an article he wrote in the WSJ about a month ago .. the reporter was not invited to this past week's FOMC Press Conference.

LINK HERE to the article

LINK HERE to Boom Bu$t discussion on it

Read on »

AIG & Bailouts Boom Bu$t .. a look at the former CEO of AIG, who filed a lawsuit against the U.S., arguing that the government had acted improperly when bailing the corporation out in 2008. And he won! .. 1/2 hour total program

Read on »

What does Greece have in Common with Illinois? In his latest letter, John Mauldin* sees Greece as serving as a lesson for the rest of the periphery of the euro zone - Greece will have to become more serious in its reforms .. in a similar way, Illinois is going to serve as a lesson for the resto fo the 49 U.S. States - "You can look at the table we highlighted earlier and see whether your state is headed in the wrong direction. Many states are in relatively good shape, and a few reforms can make them even better. There are some cities that are disaster zones, and they will be sad cases; but a serious majority can fix their problems if their politicians start to take action now. Pension reform will not be popular with the unions; but, as we can see from Illinois, even relatively modest changes were unpopular, and now the state is careening towards a civic financial collapse."

Click "Mauldin June 20" to download Mauldin's letter (may need to provide your email address), or hit "View Fullscreen" at the bottom next to the Scribd logo to enlarge viewing .. John Mauldin, Best-Selling author and recognized financial expert, is editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

Read on »

Greek Default to Trigger 48-Hour Global Meltdown! Palisade Radio interviews Bill Holter, with a special focus on Greece .. Can you identify which government bonds have seen yields rise 20-fold over a 4-week span? .. Why a default in Greece is liable to create a global meltdown in just 48 hours! .. How China & Russia are teaming up to get out of the U.S. system? .. And what China is doing in particular to create favorable deals for their economic partners .. 15 minutes

Read on »

click to enlarge

Read on »

OUTSIDE OUR BOX The Forgotten History of Autism Sunday Night Special Many years ago, only a few pediatricians heard of autism .. In 1975, 1 in 5,000 kids was estimated to have it. Today, 1 in 68 is on the autism spectrum. What caused this steep rise? Steve Silberman points to "a perfect storm of autism awareness" — a pair of doctors with an accepting view, an unexpected pop culture moment & a new clinical test. But to really understand, we have to go back further to an Austrian doctor by the name of Hans Asperger, who published a pioneering paper in 1944. Because it was buried in time, autism has been shrouded in misunderstanding ever since .. 14 minutes

Read on »

Insolvency Risks in U.S, Europe & Japan are Increasing "One has to wonder, if worldwide economies are barely growing with free money how they will fare as rates start to spike. But the cheerleaders on Wall Street love to cite rising rates as evidence the global economy is improving. They argue rising rates are a healthy sign, proof that the U.S. and European economies are strengthening, people are spending, companies are hiring and prices are starting to rise at more normal rates. And more importantly, the risk of too-low inflation—whatever nonsense that means–has ended .. This is the same crowd who was convinced rising rates wouldn't hurt the housing market back before the financial crisis - because a bubble didn't exist, and even if one did the demise of subprime home buyers wouldn't spill over to the overall economy .. Wall Street and Washington fail to realize that rates are rising for all the wrong reasons. For instance, the yield on the Ten year in Greece has now skyrocketed to around 12.5%. Is this a result of budding optimism in the Greek economy? No, the rising rates in Greece represent the increasing likelihood of a Greek default .. Here is the truth behind the global rise of interest rates: Interest rates are spiking due to the increased insolvency risks in the American, Japanese and European social welfare states that have piled on an incredible $60 trillion of new debt since the credit crisis."

- Michael Pento

LINK HERE to the essay

Read on »

Jim Rogers*: World Bank & IMF are 'Corroded' Jim Rogers* says the world needs alternatives to the U.S. dominated World Bank & IMF financial institutions .. "The world needs something to compete with the US-dominated institutions, some of them – the World Bank and the IMF- have become corroded and ineffective. So, if BRICS offer any new structures that can compete with these long-standing decomposed institutions, it will be very good. Good for the whole world, including Russia and China .. There's not much alternative right now but eventually the U.S. dollar is going to be replaced with something else, perhaps the Chinese renminbi." ... 9 minutes

LINK HERE to the podcast

Read on »

Peak Prosperity News Update Chris Martenson points out that Greece is about to default at this point .. warns Greek bank depositors that they may be losing the bank deposits soon as banks go bankrupt or restructure .. explains why the problem has been with Greek banks making bad loans - why should the government keep bailing out banks who make bad decisions? .. 5 minutes

Read on »

The Ban On Cash, Big Brother & What Has Western Central Planners So Terrified Egon Von Greyerz identifies several trends in financial repression among indebted western world countries .. "The Fed, which is the central bank that should take the leadership in solving the problem, is the party that has actually caused the mess. The Fed does not have a clue what to do. They believe so much in their own rhetoric and all the phony and manipulated economic figures that they don't even recognize the economic decline that is happening in front of their eyes." .. von Greyerz sees the economically weak countries as pushing for the ban on cash.

LINK HERE to the article

Read on »

The Coming Era of Pension Poverty Charles Hugh Smith* & Gordon T Long* discuss the unsustainability of pension funds for U.S. public employees, the challenges of ordinary retirees to be able to retire given the financial repression on interest rates & low yields .. while everyone is beginning to agree that most people will not be able to retire, but must keep working, many do not realize that there are already "means-testing" in place for the U.S. social security benefits because if you & your spouse keep working & make at least $44,000 per year, your U.S. social security retirement benefits will be reduced by 85%! .. 26 minutes

Read on »

click to enlarge

Read on »

"There Is No Saving This Financial System"

Nomi Prins* "When it implodes it will implode dangerously. They want rates to stay low because they don't know what's going to happen to the global financial system if the availability of cheap money goes away .. Right now everyone knows, whether they admit it or not, that (cheap money) is the only thing that's keeping this system afloat. It isn't production. It isn't savings of individuals because nobody has any money to save .. So the only policy that these central banks have is to continue to do more of the same. And the only thing is continue to push this next crisis, or the second leg of the current crisis as I look at it, down the road. There is no saving this system .. All they can do is continue to push the current policies to make it look as if things are operating functionally — as if these banks are solvent and as if these markets are somehow elevated on the basis of value and not on the basis of the cheap money that they are infusing into the system. That's all they can do. They just hope that somewhere along the line this will work out." .. 20 minute podcast with Nomi

LINK HERE to the article & podcast

Read on »

Interview with Professor Laurence Kotlikoff Boston University's Kotlikoff is an expert on debt, the U.S. social security system - "the U.S. is broke" .. 15 minutes

Read on »

Tom McClellan Predicts Major Market Peak This August, Bear Market Into 2016

LINK HERE to the article

Read on »

Turmoil Coming to the Markets: Prepare for Bear Market in Bonds Dr. Ron Paul* on how big changes are on the way for the U.S. economy! .. he is out with a warning on what to look out for & why .. 17 minutes

Read on »

click to enlarge

Read on »

Peak Prosperity's Chris Martenson highlights the big signs of stress now becoming manifest in the credit markets - liquidity & volatility .. "Today's markets are so distorted that you can reasonably argue that there's not much in the way of useful signals emanating from them. And I wouldn't put up too much of a counter-argument. But it's my contention that the bond market is the place to watch as it will provide the most useful clues that a reckoning has begun. And when these markets eventually return to earth, there will be blood in the streets .. Our financial markets may simply stop working when this "mother of all bubbles" -- comprising both equities and bonds -- finally bursts .. Given the much greater size of money and credit that will be desperate to find an exit, and the lack of remaining options the central bankers have now versus then, the financial crisis may look tame in comparison."

LINK HERE to the essay

Read on »

Got Risk? A Deep Economic Dive With Josh Steiner on Interest Rates, the Fed, Housing & Markets Hedgeye interviews macro analyst Ben Ryan on The Macro Show. Their in-depth conversation covers a ton of financial ground & is a must-see discussion of the key issues & risks facing investors right now .. 30 minutes

Read on »

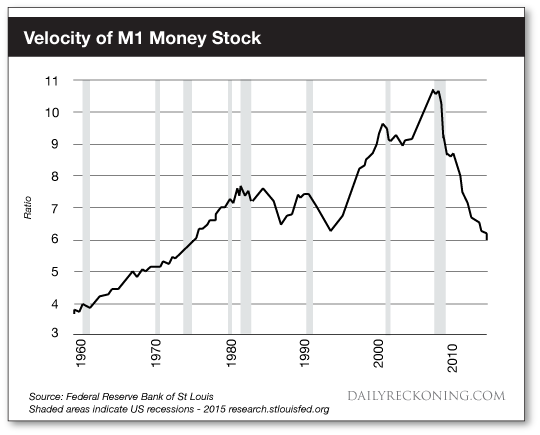

Deflation & Disruption Jim Rickards* discusses the economic relationships between deflation, inflation, money supply, money velocity & economic GDP .. what he emphasizes is the need for the Federal Reserve to balance strong deflation forces with even stronger inflationary forces: "For now, the Federal Reserve is stymied. The psychological, technological and demographic trends causing deflation are not going away. The Fed cannot tolerate deflation because it increases the real value of debt and jeopardizes the banks. The Fed will be forced to return to its inflation tool kit of quantitative easing, currency wars and perhaps 'helicopter money' in the year ahead. These dominant economic trends — natural deflation countered by policy inflation — produce a rich set of indications and warnings."

LINK HERE to the essay

Read on »

Greece May Default But Not Leave the Euro Zone  | | oversized caption for clarity- click to downsize |

Sober Look identifies a possibility which sort of makes some sense - Greece could default without leaving the currency union .. "With a strong support for the euro, Greeks could push for a referendum to form a more centrist government that would re-engage the creditor institutions." - summary from Barclays Research above .. [Cliff Note: This possibility meets the geo-political "requirement" for the U.S. & Europe to keep Greece out of Russian hands, but at the same time recognizes the reality of Greece's current bankruptcy.]

LINK HERE to the commentary

Read on »

Double Digit Annual Inflation In Many US Cities Wall St For Main St interviews financial expert Ed Butowsky created the Chapwood Inflation Index to better accurately measure inflation in the U.S. compared to the Bureau of Labor Statistics' Consumer Price Index (CPI) .. discussion on the problems with the CPI and why it no longer measures inflation accurately .. an example of obfuscation - one of the pillars of financial repression .. 29 minutes

Read on »

click to enlarge

Read on »

|